Finally, the balances are compared again, at which point, both should be equal. Once the types of differences are identified and adjusted against their relevant balances, the balances should be compared again. The ledger balance is where all the company’s money moves are written down—like sales, buying stuff, and paying out. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice.

- These differences are adjusted against the bank statement balance but are not recorded in the bank statement.

- If you do your bookkeeping yourself, you should be prepared to reconcile your bank statements at regular intervals (more on that below).

- You should conduct a bank reconciliation at least monthly, typically at the end of each month when the bank statement is received.

- ✅ Linked Sales, Purchase & Payment Records — Every order or payment made in Kladana is auto-recorded in the finance module, helping you trace transactions during monthly or quarterly reconciliations.

- Apart from these types of differences, errors may also occur on either the business’ side of the records or the bank’s side of the records.

Preparing a Bank Reconciliation Statement

We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will manage your bookkeeping and file taxes for you. More specifically, you’re looking to see if the “ending balance” of these two accounts are the same over a particular period (say, for the month of February). Bank reconciliations may be tedious, but the financial hygiene will pay off.

Free Course: Understanding Financial Statements

- The second entry required is to adjust the books for the check that was returned from Berson.

- Most importantly, they free you up to focus on running your business, without worrying if your numbers are incorrect.

- This summary details the withdrawals, deposits, and other relevant activities that may impact a bank account within a specific timeline.

- A few simple habits can make bank reconciliation faster, easier, and more accurate.

- The reason could be that deposits are in transit or outstanding checks have not yet been reflected.

- Therefore, there are a few steps that need to be carried out to ensure that proper bank reconciliation has been carried out.

- Regular Bank Reconciliation Statements contribute to better financial control by providing a clear picture of a company’s cash flow and bank activities.

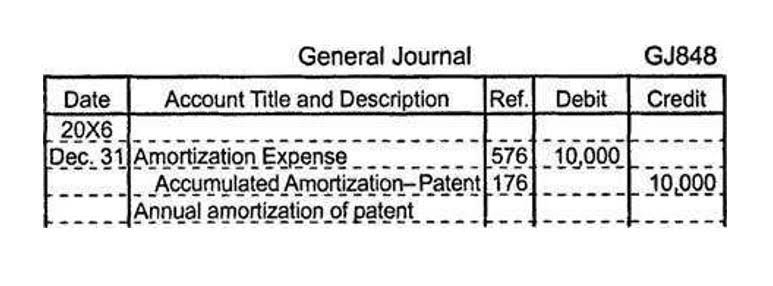

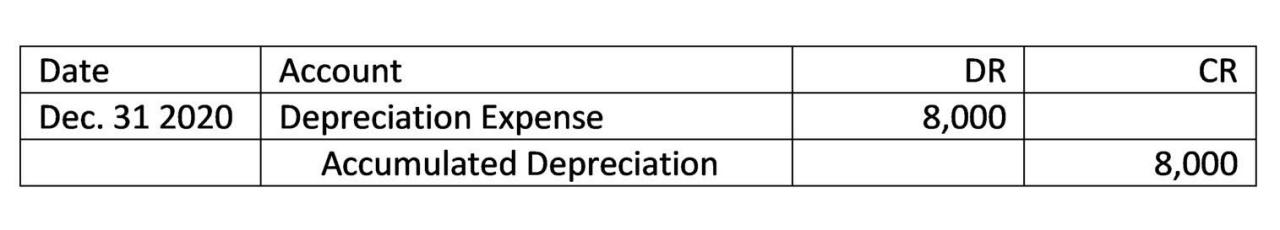

After adjusting the balance as per the cash book, you’ll need record all adjustments in your company’s general ledger accounts. When your business issues a check to suppliers or creditors, these amounts are immediately recorded on the credit side of your cash book. However, there might be a situation where the Bookstime receiving entity may not present the checks issued by your business to the bank for immediate payment.

What is bank reconciliation statement and Who prepare it?

Bank statements are more than just records of financial transactions; they are a window into the… Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank. It means that these omissions have led to increase in the balance of cash book, so these items should be subtracted from the balance of cash book. For example, a cheque for Rs. 4,000 had been dishonoured, however, no adjustment had been made in the cash book. As a result of these direct payments made by the bank on your behalf, the balance as per the passbook would be less than the balance as per the cash book.

Bank Reconciliation Outline

These debits made by the bank directly from your bank account will lead to a difference between balances. After adjusting all the above items what you’ll get is the adjusted balance of the cash book. As such, an overdraft balance is treated as a negative figure on the bank reconciliation statement. By following these best practices, you’ll transform bank reconciliation from a necessary evil into a valuable business process that provides real insights into your cash management and financial controls.

- This insight is invaluable for effective cash flow management, as it enables businesses to make informed decisions regarding expenditures, investments, and strategic planning.

- Ultimately, the decision to add interest earned to the bank statement balance during the reconciliation process hinges on aligning the reconciled balance with the company’s actual financial position.

- One of the most common causes of discrepancies in bank reconciliations is delays in deposit and transaction processing.

- On detailed scrutiny of two records, the accounting manager found the following transactions are missing in either of the books of accounts.

- The business has to identify any differences between the balances in these two documents and reconcile them in order to ensure proper control over it bank balances.

- These further adjustments are made when the data is compared with the account balances depicted in the bank statements.

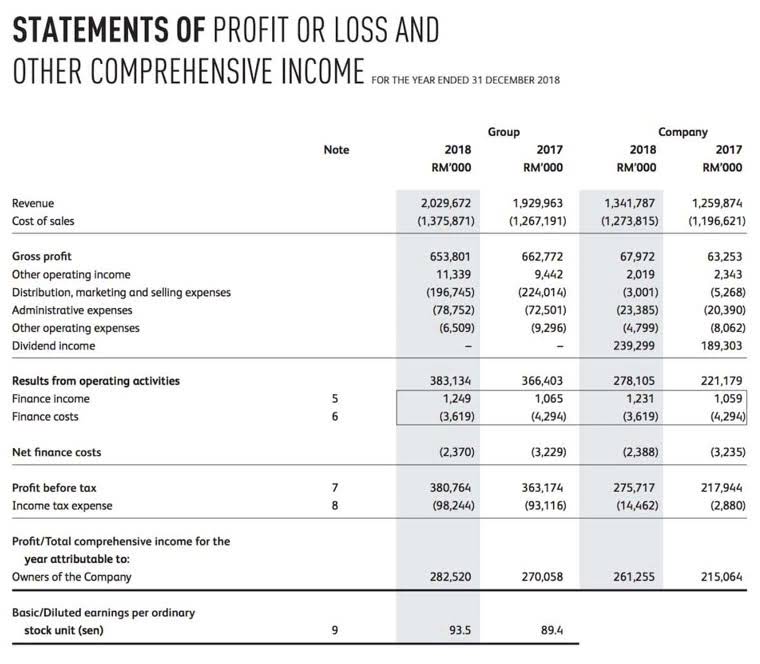

This fact-based insight is critical for managing cash reserves, planning future investments, and budgeting for growth or new initiatives. Bank reconciliation directly supports the accuracy and reliability of all your financial statements. It is not just a compliance task—it also supports tax returns, comprehensive reports, and business strategy. For example, if a supplier payment shows on the bank statement but is missing from your ledger, reconciliation prompts you to record and categorize it correctly for future clarity. Understanding these terms will help you follow the steps and appreciate the importance of bank reconciliation as you manage your bookkeeping processes. Whether you are running a small business or managing a large operation, regular bank reconciliation forms the backbone of careful bookkeeping.

On the other hand, deposits in transit are the opposite of outstanding checks. Deposit in transit refers to any checks that the company has received from another party, mostly customers. Deposits in transit are also checks that the company has presented to the bank, but the check did not clear before the preparation of the bank statement. Apart from fraud, bank reconciliation can also help a company detect errors. bank reconciliation Performing regular bank reconciliation can help the company identify any issues within its internal processes related to bank transactions that may result in errors. It can, in turn, help the company improve its bank processes and make them more efficient and effective.

- When these records don’t match – and they often don’t due to timing differences and pending transactions – bank reconciliation helps explain why.

- Reconciliation reports provide a summary of the reconciliation process and help to identify any errors or discrepancies.

- For example, a cheque for Rs. 1,000 had been wrongly entered in the cash book as payment.

- These checks will have the word “VOID” clearly written across the front of the check.

- Outstanding checks are those that have been written and recorded in the financial records of the business but have not yet cleared the bank account.

- Bank reconciliation is the process of verifying that your business’s recorded transactions match your bank statement.

What to Look for When Preparing a Bank Reconciliation?

Once you’ve identified all the items that align between the two records, it’s time to account for retained earnings any discrepancies. These may include deposits in transit, outstanding checks, bank fees, or miscalculations by the bank or the internal accounting team. You receive a bank statement, typically at the end of each month, from the bank.

Step 3: Adjusting for Bank Errors and Adjustments

Any portion of the notes receivable that is not due within one year of the balance sheet date is reported as a long term asset. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Related benefits include remote backups, disaster recovery features, and easy integration with payment processors or other business tools.